Why it Pays to Pay (your Agents)

Agent-based systems are doomed to fail without the right investment

👋 Hi there, Juan Gabriel here, and this is where I write about the ideas, companies and people redefining the future for the next billion internet users. Thanks to the +30 people that signed up since the last piece! If you want to join, hit this button 👇🏻

🔥 Build it now lest we crash

Building companies for emerging markets can be humorously described as laying train tracks from a moving train🚂.

Source: Aardman

That means building a company…all the while building the base infrastructure your company needs to run an MVP (minimum viable product). Think about it, when Marcos Galperin, Hernán Kazah and Stelleo Tolda kicked off Mercado Libre in 1999 they could not rely on the local post so they had to build delivery in-house. It is a similar story for Sacha Poignonnec and Jeremy Hodara with Jumia, and even Jack Ma with Alibaba. Compare that with Jeff Bezos in 1994: when Amazon started selling books from the garage of Bezos’ suburban Seattle rental, the company relied on USPS —the national postal service— to ship goods nationwide.

The mindset for global founders is not “build it and they will come” but rather “build it now lest we crash.”

📈 Why it Pays to Pay your Agents

If you don’t want to build things in-house from scratch, an alternative is to rely on a series of agents—merchants that will distribute your good or service for a fee. Given logistical challenges, agents are a great means of reaching large populations at low cost. In many countries, agents-networks are the easiest way to reach rural and smaller cities beyond the capital. At its crudest: if you are a start-up you can use your capital more efficiently by leveraging existing stores —a small neighborhood store here, a food cart there— to create multiple access points your product or service.

The question is: how do you get agents on board?

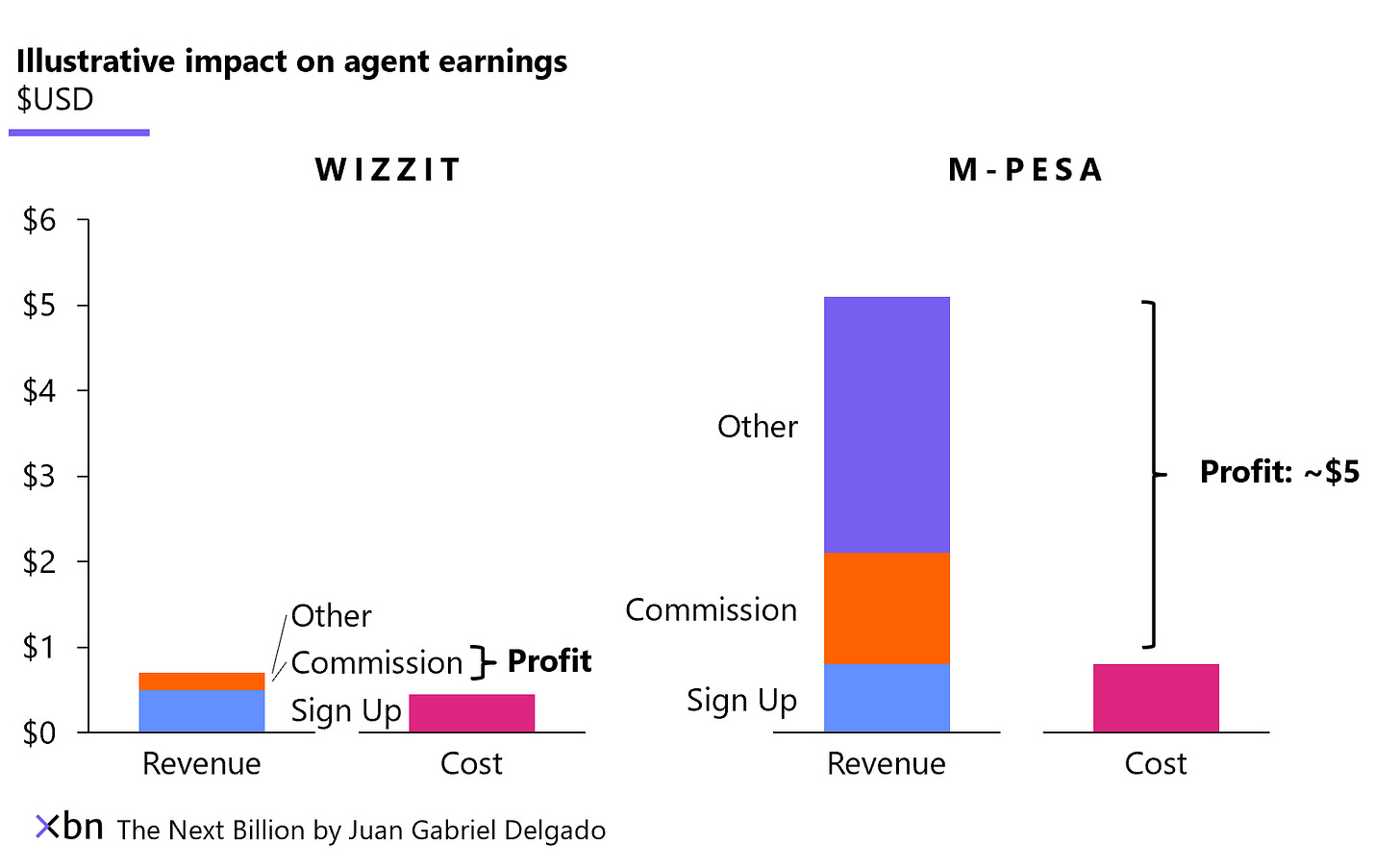

It has to make sense for the agent…to be an agent. While this is hardly a revolutionary revelation, it is not that easy to get right. Let’s consider how to effectively set up agent networks by comparing two African companies that very different approaches to compensating agents: Wizzit (South Africa) and Safaricom with M-PESA (Kenya). 1

🏧 Wizzit | ‘WizzKids’ day-in-day-out

Founded in 2004 in South Africa, Wizzit was one of the first mobile-first banking platforms. The product was remarkable, they made a banking platform fully functional on feature phones…in 2004! For context, this is something several companies are perfecting on feature phones even though it is 2021.

To reach customers, Wizzit recruited what it termed “Wizzkids” a series of unemployed youth trained to educate and gather clients as banking agents. Wizzkids moved along to corner shops, farms, malls and more to set up pop-up stands to explain the product and recruit customers (see a snapshot of a kiose below).

Source: CGAP

How were these WIZZkids compensated? In 2008, WIZZkids received a commission of R20 (~$2.67 based on that year’s exchange rate) and a small payment based on how active the customers they signed up were on the platform. In general, this was was a poor value proposition for WIZZkids. While it offered flexibility, allowing agents to seek their customers on their own time, WIZZkids needed to recruit large numbers of users to make a decent living.

Let’s quickly run the numbers: to reach national income —GDP per capita— a single WIZZkid would need to recruit +1,600 customers in a single year! I’ve also broken it down by different ethnoracial categories to understand the spread in the context of South Africa, but the message is the same, WIZZkids are unlikely to hit that number or make a decent living without additional income streams.

Source: own analysis with World Bank and SAIRR data

That doesn’t take into consideration another problem with the Wizzit model: opportunity cost. Working in the field recruiting customers full-time means that WIZZkids had little time to work on other side hustles (e.g., agricultural work, services, etc.) or take care of other domestic or family duties. It would be better to recruit WIZZkids with existing small enterprises, perhaps a small service or a stand selling food, snacks or other goods where signing up customers has negligible marginal cost. Then, WIZZkids can go about their day-to-day and have the option of additional income from Wizzit services.

🤙 M-PESA | Incremental Income for Agents

M-PESA, the world’s leader in Mobile Money is a textbook example of how to successfully establish an agent network (if you need a primer on Mobile Money, I suggest this brief video). For context, M-PESA was set up by Safaricom, Kenya’s largest telco operator with thousands of airtime and SIM card agents.

It would be natural to assume that Safaricom used its existing network of airtime agents to distribute M-PESA. However, Safaricom realized that they could not use their existing network because airtime agents had a strong disincentive to sell mobile money. If customers bought M-PESA mobile money, they could then refill airtime directly from their phones without the need to visit their agent. As an agent, this was substituting one revenue stream for another (airtime sales for mobile money), instead of creating an incremental revenue stream.

As a result, Safaricom spent significant effort building their own agent network by onboarding neighborhood stores and small retailers that were not yet selling airtime. Safaricom rarely recruited individual workers as agents—as was the case with Wizzit’s ‘Wizzkids’—opting for small establishments instead. Why? Because this meant that any income from M-PESA for the agent would be incremental to the existing business and would bear little opportunity cost. If you were selling key goods at a small convenience store, you could continue selling uninterrupted without the need to hustle around a Wizzit kiosk. What’s more, if you were an M-PESA agent, you might even see more traffic in your store as customers drop in to buy mobile money but end up making ancillary purchases. Studies estimate that M-PESA agents made an average profit of $5.01 per day after incorporating commissions, sign up bonuses and other income streams (like these ancillary purchases). I’ve produced a simple visualization below but CGAP has more detailed income profiles for M-PESA merchants.

Source: own elaboration based on CGAP data

Beyond that, ~$5 a day means an annual income of ~$1,825 in a country with a GDP per capita of $905 in 2009 (the same year as the CGAP income study). That’s nearly twice the average income! Evidently, this won’t be the reality for every M-PESA agent, but these quick calculations suggest that being an M-PESA agent in Kenya is far more profitable than being a Wizzkid in South Africa. The takeaway is: 💲 it pays to pay your agents well 💲.

Poorly-compensated agents will not think it is worth their time to promote your product and may churn or become dormant. Meanwhile, well-compensated agents will have both the willingness and the ability to promote your product to see their business grow. Franky, I think this is one of the reasons why mobile money became such a runaway success. Last year, the value of mobile money transactions was nearly half of Kenya’s GDP (Note: this includes M-PESA and other mobile money providers).

If you’ve been following up to this point you might be thinking: “So what? These examples are more than a decade old, are the learnings still relevant?”

My answer is an enthusiastic YES: today’s most successful agent-based companies services have taken this learning to heart…let’s jump over to South East Asia.

🎺 All about that ‘Fazz’

Founded in 2016, Payfazz is an Indonesian digital platform that enables online payment points across physical locations in Indonesia and neighboring countries. Payfazz works with banks, service providers and other partners to help customers pay for services that include paying utilities, school fees, transferring money, and more. How? Payfazz recruits agents from informal businesses that can help provide partners services (e.g., payments, bills, remittances, etc.) throughout the country.

In contrast to super-app giants Grab (GrabPay) and GoJek (GoPay) which focus on the banked population in large cities (~20% of the population), PayFazz focuses on the unbanked and underbanked population in smaller cities (80% of the population). If you don’t have a bank account, no problem: you can go to a local Payfazz agent —often a neighborhood store— pay in cash, and have the money sent to the recipient via the Payfazz app.

Source: KrAsia

Payfazz’s business of recruiting and validating an agent-network to offer payment services has been incredibly successful: the firm has more than 250,000 agents serving more than 10 million users! For context, it took M-PESA fifteen years to reach its current 160,000 agents.

Signing up as an agent is a relatively straightforward process:

Applicants sign up and register through the Payfazz App

Payfazz validates the identity of the applicant and creates a balance on Payfazz linked to one of Payfazz’ bank partners

Agents may then use their balance on the Payfazz app to pay for customer needs in exchange for cash

Beyond that, Payfazz’s CEO Hendra Kwik says that agents see their income increase by at least 20% on multiple accounts:

By becoming Payfazz agents, they [agents] will get an additional channel of income and expand their network or customer base. In addition, micro and small business owners will be able to establish a digital financial identity through Payfazz. This opens up opportunities to get funding to grow their business

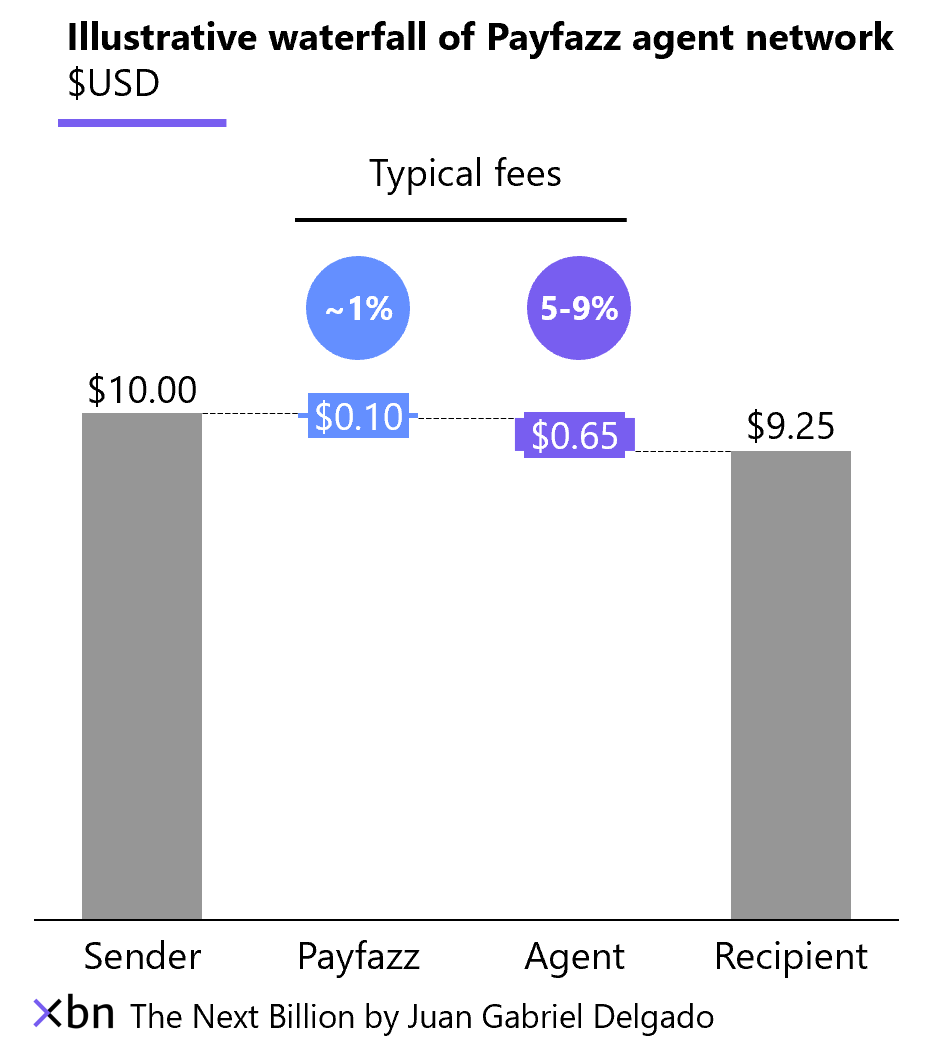

Unlike Wizzit and M-PESA, agents are not directly rewarded for signing up people on Payfazz. After all, Payfazz agents mediate their customer’s cash payments via their Payfazz account and its linkages to the formal banking system. However, Payfazz does create upside opportunities for agents by offering them a margin of the volume of payments they transact: the firm generally takes 0.5-1% on every transaction but allows agents to set their own margins, which typically vary between 5% and 9%. A quick waterfall of a $10 payment is below.

Notice that this means that individual agents are taking—at minimum—5X more margin than Payfazz itself. This is a handsome reward, but the total upside is perhaps much larger. After all, Payfazz agents are established small and micro-businesses that can benefit from greater footfall at their stores, as was the case with M-PESA.

To make up for low transaction margins on agents, Payfazz also facilitates loans between agents (potential borrowers) and lender partnets. Its position as the ramp between cash payments paid-in to agents and transactions with partner banks gives it a good visibility into an agent’s cash-flow and finances. As I discussed in a previous article, this information is extremely useful to understand the credit risk and cash-position of a business (or individual worker). Payfazz monetizes this by earning a variable commission rate that varies anywhere between 4% and 10% per year from the lender partner backing the loan.

Overall, the firm’s agent-based business model seems to be paying off. Last week Payfazz announced a $30M investment in Xfers —a payment API and software developer already used by Payfazz—to create a unified payment system across South East Asia.

Final Thoughts

Properly compensating agents is essential. With agent-networks one of the lowest-cost and most efficient means to reach scale , start-ups must ensure their agents are invested in promoting the company’s products.

Compensation goes beyond directly supporting the start-up’s activities. Instead, it can take the form of boosting the agent’s existing activities by means of increased footfall or by opening up the door to additional services (e.g., loans at lower cost). Insufficient compensation can decrease an agent’s willingness to provide your service and may even diminish the customer experience.

Finally, the importance of agents will not decrease as a billion or more internet users come online. While the value of paying in cash at a a local agent might decrease, agents will remain at the core of local communities and local economies. They will continue to be a key entry-point for services beyond the capital.

Thanks for reading 🙌 If you have feedback or questions, let me know by leaving a comment below, contacting me on Twitter or LinkedIn. If you liked it, please share!

Let me know your thoughts on this piece!