👋 Hi there, Juan Gabriel here, and this is where I write about the ideas, companies and people redefining the future for the next billion internet users. Thanks to the +60 people that signed up since the last piece! If you want to join, hit this button 👇🏻

Source: Mani Bharatavi Ravi

No matter the geography, incumbent banks have been waging war against fintech start-ups that are either disrupting the banking ecosystem—think Mexico’s Klar or other ‘challenger’ banks—or creating entirely new ecosystems—think of Shopify’s online pop-up stores. Everyone is obsessed with what new start-ups are cooking up to ‘challenge’ the status quo or ‘reinvent financial services’.

This week, I’m going to take a look at how incumbent banks are making moves to defend their privileged position with an example from Perú: Yape. Beyond consulting firms like Deloitte or McKinsey publishing white papers on how financial institutions can transform their business, incumbents don’t get much credit for their efforts. In general, I think incumbents are dragging their feet. But, Yape shows how incumbents can get their mojo back. After all, it seems like Banco de Crédito del Perú (BCP)—the bank behind Yape— has understood one of Steve Jobs’ most overused quotes (which I’ll relish in reposting here).

“if you don’t cannibalize yourself, others will”

⏳ Yape: About time already

Yape is Peruvian slang. It’s an abbreviation of “Ya pues” (Ya pues → Ya ‘pe → Yape) which roughly means “Come on, do it”. It’s the same phrase I used to blare at teammates when they missed an easy goal during football matches (⚽ not 🏈 of course), or guilt friends to come out to a social gathering. It conveys the same exasperation and impatience directed at someone hesitating or moving slowly. It’s ironic that a bank would get around to ‘doing it’ and launching their own cannibalization.

BCP launched Yape in 2017 as a P2P app on the bank’s debit card rails. Its initial use case was to be Venmo in Peru: digitizing many of the small and frequent cash interactions between friends and co-workers common to the yuppy segment of BCP’s customer base. Over time, Yape evolved to include Peer-to-Merchant (P2M) functionalities and become a full-fledged digital wallet. That doesn’t sound particularly innovative, right? Well, because Yape was created by Peru’s biggest bank it’s a proactive response to challenger fintechs / neobanks and a key channel to reach Peru’s 16 million unbanked. And, its been doing quite well: since 2017, it has grown to +5 million users reaching more than a fifth of Peru’s banked population.

🚄 Covid Turbocharge

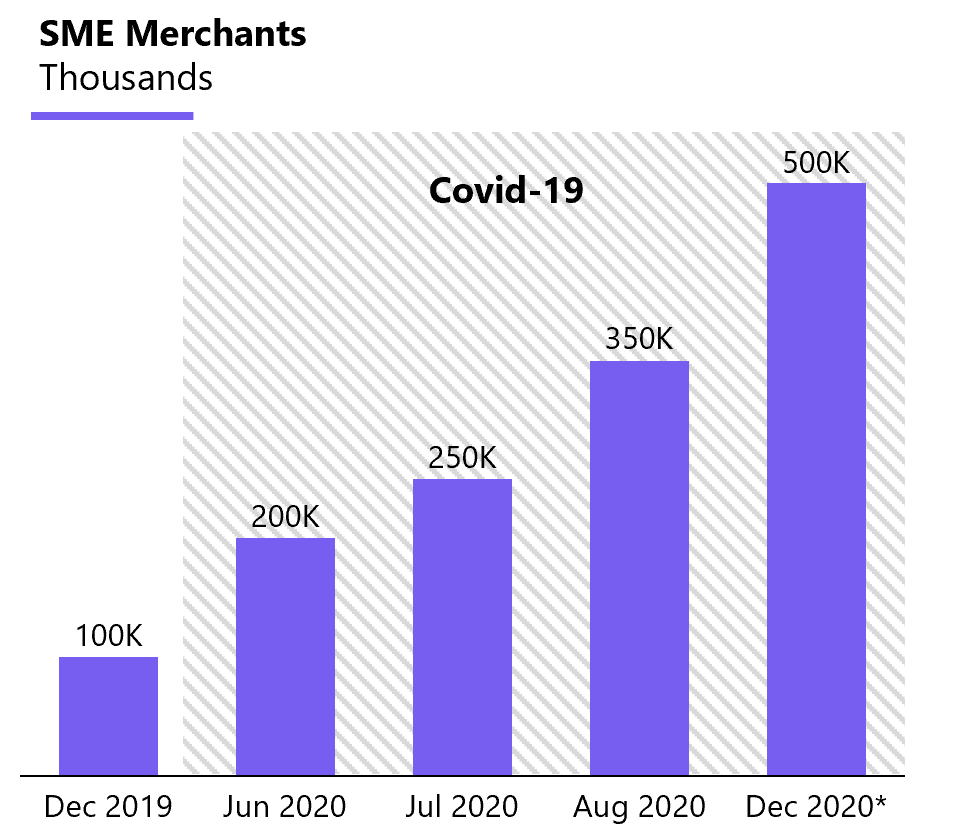

Yape’s ambitions for 2021 are commensurate with its trajectory, it hopes to nearly double its user base and reach 10 million users—that’s almost a third of the country (and a dominant share of the banked users)! It’s been helped by Covid-19: the pandemic catalyzed growth increasing user adoption from 200k to 350k per month, almost doubling its growth rate. This has led to impressive feats across key metrics that include daily user sign-ups (200% increase), monthly transactions (450% increase), and transaction value (340% increase). These are ‘hot-shot’ Silicon Valley stats, and prove—once again for the people in the back—that this kind of growth is possible in emerging markets.

But Yape’s was already on a successful trajectory before the pandemic. What did BCP and Yape get right?

Why Yape is succeeding

There are three keys to Yape’s success:

1️⃣ Establishing an open network

At its inception Yape was only for banked BCP customers. That’s a sizeable chunk of the banked business in Peru, but still well short of its potential. It is also the kind of move a bank would make, cautious to avoid a price war with competitors, but dredging a deeper moat to retain its existing customers. However, Yape wasn’t thinking like a traditional bank—it wanted to go after whole market. So, in 2018 Yape opened up its P2P platform to enable payment to non BCP customers: a BCP/Yape customer could send funds to a friend at a competitor bank for free because Yape would cover any fees. It is important to recognize that this is a big move for a bank: in essence it means Yape would subsidize transactions to other banks. It also created a new use case for Yape that extends beyond its corner of the market. For some, this may have been enough to switch from competitor banks to Yape, but more importantly it meant Yape established its brand so that exchanging money via digital wallets became ‘Yapeame’.

2️⃣ Using Quick Response (QR) codes to onboard merchants

I’ve already evangelized the merits of QR codes (make sure to read it if you need a refresher). But in short QR codes are 2-dimensional barcodes that are widely used in Asia to mediate smartphone transactions at low cost.

In 2019, Yape created QR functionalities on its app while also creating P2M services so that customers could buy goods with just a snap and a touch. What’s neat about QR codes is that it allows merchants of all sizes from large department stores to small corner stores to accept payments with a cheap and printed code—no need for a chip reader and fewer cash safe boxes. A growing network of users meant the use value of Yape grew with every single merchant or merchant network that accepted Yape: need to pay your taxi driver? Yape. Buying a coke at the corner store? Yape. Paying for a regular cleaning at the dentist? Yape. Yape now counts more than 500 thousand merchants in its network.

Because Yape doesn’t charge large fees and enables immediate cashless transactions, the benefits for merchants are clear: more transactions and less handling of cash. According to Kristy Fernández, Yape’s Product Manager:

Participating bodegas now handle 60% of sales through Yape. The average transaction value has grown now that transactions are weekly, not daily. The average Yape transaction grew from ~$14 (S/50 Peruvian nuevos soles) ) to ~$21 (S/ 76).

3️⃣ Focusing on growth with the unbanked

The banked population represents only 33 percent of Peru’s adult population. Yape has shifted product strategy to focus on capturing that remaining 66 percent. Though it has a long way to go, it has been creating the right products.

In 2019, Yape launched YapeCard, a product extending Yape’s digital wallet to the unbanked. Users could sign up with nothing but a phone number and their national identification number (government issued number) and start receiving funds immediately.

To seed their accounts, YapeCard users can pay someone in cash and ask for an equivalent transaction through Yape—and Yape is building a system of agents to further facilitate these transactions. Once funds are seeded customers can buy and transact at no cost. There are limits on transactions that can be enabled through the Yape Card to comply with regulations and reduce fraud. YapeCard members can send up to $140 (S/ 500) per day on Yape and withdraw the same per day at any BCP branch while holding a maximum balance of ~$2,780 in their digital wallet. These are solid numbers, and enable unbanked and informal workers to reduce their reliance of cash.

What’s more, BCP is likely to use transaction data for customers to get a good sense of cash flow for individuals and then offer low-cost banking or credit services to a larger segment previously ignored.

Quick reminder to subscribe if you’ve enjoyed so far! 👇

➕ Putting it all together

Yape’s product roadmap has created a flywheel built on three reinforcing cycles:

Network Effects: Yape’s ability to onboard merchants at scale—big and small—creates more use cases to make digital payments widespread in Perú. This is coupled with the BCPs existing network of agencies and partners to help create on and off-roads for cash to the digital wallet system.

Reinforced Circulation: By shifting the day-to-day transactions of unbanked users from cash to the digital wallet, Yape increases the circulation of funds in its ecosystem. The more funds seeded in the system, the more likely people will prefer to send or receive via Yape than bank transfers, cash or other alternatives.

Strengthening Brand Affinity: Both the result of network effects and reinforced circulation, locks in preference over Yape over competitors. In addition, as previously unbanked users get access to basic financial services, it generates strong brand loyalty (in general few people change banks and get locked in). On the other hand, already banked users may benefit from more personalized financial services as Yape and BCP use transaction data to tailor all sorts of products and consumer behavior to deliver an exceptional customer experience in the country.

🔥 Hot take: that’s a good thing

Yape is an incumbent app that’s done well…so what? Well, it shows that incumbents can fight back against new challengers and I think that’s a great thing: banks should directly compete with fintechs even if it means sometimes they win out. In most cases, it will produce a comparably good outcome for the next billion internet users. Here’s why:

Many think of the value that a firm or product delivers to key customers as its main social impact. In general, this is known as the firm impact, the direct consequence of offering a product or services for customers. However, it is equally important for investors to consider the ecosystem-wide market impact from a product or firm. Often, a firm’s market impact far exceeds its firm-level impact. Yape is an example of both.

Yape facilities zero-fee or low-fee P2P and P2M payments in Peru. By focusing on the unbanked and offering an on ramp for informal workers and the unbanked to use digital payments, it has direct impact by mainstreaming the marginalized. This is direct impact.

Yape does more, it also generates market-level impact. It is shifting the behavior of other incumbents. In 2020, several of the largest banks in Peru —BBVA, Scotiabank, and Interbank— developed PLIN, not a standalone P2P application but rather a functionality between apps that allows free P2P and P2M payments on similar debit rails as a means to compete. Whereas in the past customers needed to send money via expensive and slow interbank transfers the whole Peruvian banking ecosystem can now send bank transfers at low cost (note that this is not universal across banks, but rather across two competing PLIN and Yape networks). This means lower costs for consumers and more opportunities for accessing much needed services. This is similar to how Charles Schwab or Robinhood democratize access to wealth management by making the waiving of these transaction fees standard the industry.

I’m not arguing incumbents should always win against nimbler players. Incumbents should compete against new players and other incumbents. In doing so, the presence of a new upstart, or even the threat of one can lead incumbents to change the ecosystem to favor users. There’s more to be seen as Yape progresses, but one thing is clear: BCP is not waiting around for someone else to ‘disrupt’ them. They’d rather do it themselves and disrupt others while they are at it.

Additional Reading

Inovar o ser cambiado - Andy García Peña (Spanish)

Winning in P2P in Latin America - Arthur Deakin

Thanks for reading 🙌 If you have feedback or questions, let me know by leaving a comment below, contacting me on Twitter or LinkedIn. If you haven’t yet, please subscribe and share!

Let me know your thoughts on this piece!