Unlocking Billions for the Next Billion

How IPO-equity can really move the needle.

👋 Hi there, Juan Gabriel (JuanGa) here, and this is where I write about the ideas, companies and people redefining the future for the next billion internet users. If you haven’t subscribed, hit this button 👇🏻

🏡 Housekeeping Update

After suggestions from readers, I will now be publishing early on Sunday. This will give me some extra time to refine pieces before sending them your way and give you time to digest outside of work. Let me know your thoughts on this.

Several weeks ago I was on a call with a senior executive at MasterCard who shared a very insightful piece of advice. He said:

Every start-up founder should set aside some chunk of shares at IPO [Initial Public Offering] to create a philanthropic foundation. It can be as high as 10% of shares or something more modest but it will add strategic value in the long term.

*Note, it is not an exact quote but it captures the gist of what he was saying.

It is a very provocative idea, and consequently, it has been spinning in my head for the past few days. Silicon Valley’s interest in philanthropy has been growing rapidly in the past few years with many founders and former founders keen on disrupting philanthropy just as they disrupted their respective industries. And, though it may not seem initially apparent, the sheer size of fortunes in Silicon Valley means that philanthropy has profound implications for the global Next Billion.

One of the most radical efforts is being led by Jack Dorsey, the founder and CEO of both Twitter and Square, boasting a net worth of $5 billion. Motivated by the Covid-19 pandemic, Dorsey has recently launched Start Small a new charitable vehicle to disburse $1 billion of his Square fortune without the need for formal applications, reporting requirements or even site visits. Radically, he’s also been sharing live updates on a public google spreadsheet (check it out below).

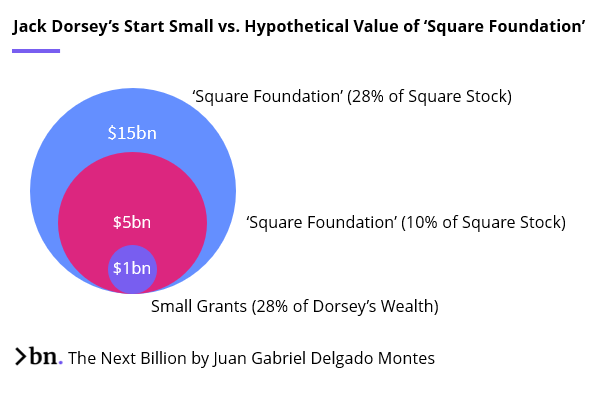

Dorsey’s quick response and flexibility is laudable in the midst of the pandemic. But it also begs the question as to how much impact a similar foundation could have made were it established alongside the company’s IPO. Had Dorsey and Square set aside a similar percentage of the company (28%) to establish a hypothetical ‘Square Foundation’ it would boast a $15 billion endowment, making it the world’s second-largest, behind only the Bill & Melinda Gates Foundation. A much more modest and realistic share of total stock, say 10%, would still seed a foundation in the Top 20!

📈 Startup philanthropy is on the rise

Although it was my first time hearing about charitable IPO equity, it’s not an entirely new idea. The first example of setting aside IPO equity for philanthropy emerged in 1998 when eBay founder Pierre Omidyar established the eBay Foundation with shares from the firm’s IPO. A smattering of other companies have taken a similar approach including Salesforce.com, which set aside 1 percent of equity in 1999 to establish the Salesforce.com Foundation. Importantly, as the share price of these companies has gone up (or down) so too the endowment of their respective foundations.

However, up until recently the number of technology companies following suit has been relatively scarce. Recode’s Teddy Schleifer describes it best as a mantra of “earn now, figure out the giving later” among founders. For a lot of people philanthropy is associated with the largesse of individual billionaires the likes of Bill Gates and Mark Zucerberg, but that has been changing…

In 2014, Salesforce.com’s Marc Benioff helped establish Pledge 1%, a movement to encourage business leaders to build charitable giving into the core of their companies. Pledge 1%’s innovation has been the endorsement of the 1-1-1 model wherein startups can pledge to give 1 percent of equity, product, profit, time or combination of these to charity. The fact that nearly 1,300 startups have made some sort of pledge to date is a positive sign. Yet it is important to keep in mind that many of those companies are not yet profitable —as I highlighted last week— many startups are targeting massive growth at the expense of profits and/or sustainability. It is possible that some of those pledges may go unfulfilled if companies go under or need to cut costs and charitable donations.

✍🏻 What’s in it for these companies?

There are numerous reasons why startups are entering the world of corporate philanthropy more eagerly in the USA.

1) The ‘purpose’ economy

Setting aside equity for charitable giving is an important means for entrepreneurs to signal a long-term commitment to giving, and giving back, to all sorts of communities. In today’s economy employees are very keen to work for a company that has a a good social ethos and that helps them fulfill a greater purpose at work. Thus, by incorporating charitable giving into the company’s structure it helps hire top talent but also retain it.

one or more people will raise a hand and say one of the reasons they picked Tableau over other organizations is they feel we’re having a positive impact in the world

2) Connecting with customers

A good company has a good connection with end-customers. One of the most important mantras in marketing is creating a positive association with brands, and, often this is done by linking products to certain virtues an values. It’s relevant beyond just B2C company, a B2B company still needs to maintain a good association in the mind of not only its business customers, but the end clients for their customer.

Recently, the Black Lives Matter movement has received significant support from corporate titans that typically shied away. This shift is partially explained by a recognition of the systemic issues of structural racism, but perhaps more so with the significant shift in popular opinion towards #BLM. Only recently did popular opinion turn favorable towards the movement, but it has transitioned very rapidly.

3) Enabling strategic partnerships

Corporate foundations also enable new forms of loose alignment and partnerships between start-ups and other players in the ecosystem. While several mature companies tend to give funds to universities to support scientific innovation, sometimes universities are reticent to accept these funds if they come directly from a corporate entity. Funds from foundations on the other hand, make it far more palatable for the vast array of stakeholders on the receiving end.

🤲🏻 What’s in it for the next billion?

This post still matters to the Next Billion because there is a lot of convergence between charitable giving and access beyond the USA and Europe. Large foundations actually do a lot of work in the emerging world and often come with less strings attached than official state aid. Let's quickly consider the foundation that led me to write this post.

Mini Case Study: MasterCard Foundation

In 2006, MasterCard (owned by a consortia of banks) went public and set aside a whopping 10% of equity to establish the free-standing MasterCard Foundation (MCF). It has a $7 billion endowment making it the 20th largest in the world.

In addition, MCF is almost entirely dedicated to helping advance economic opportunity and financial inclusion in Africa. They work out of 29 countries across Africa alongside more than 100 partners towards a common end:

Our goal is to enable 30 million young people to secure dignified and fulfilling work by 2030

Through scholarships, training delivery and investments in cutting edge innovation MCF is a powerful agent for change in Africa. In fact, the work of MCF and other institutions contribute to the creation of vibrant entrepreneurial ecosystems from Dakar to Dar es Salam. Beyond that, MCF has been investing in the region’s start-ups and helping support small and medium enterprises stay afloat under the onslaught of Covid-19.

Beyond charity, the MasterCard Foundation can be considered a a long-term strategic enabler for MasterCard. Consider the fact that nearly two-thirds of sub-Saharan Africans are unbanked and that the region is promising to grow quickly in the next few decades. Moving the needle for financial inclusion in Africa could provide millions of new customers for MasterCard and it’s services in the coming decade. That is a clear win for MasterCard, but also for the region’s unbanked.

⁉ What if all startups established foundations?

First, my guess is that many Venture Capitalist (but not all) would protest. After all it may dilute capital for investors and founder alike. However, several prominent VC firms including Bessemer Venture Partners and Foundry Group have signed up to the 1% pledge and at least encourage portfolio companies to consider how to give back through equity (or alternatively time or profits).

What’s crystal clear is that if start-ups set aside IPO equity, it would unlock billions. What we saw earlier for Jack Dorsey tends to play through: foundations would be larger, better capitalized and perhaps more influential with equity set aside at IPO. However, we do not necessarily need a foundation for each startup. In fact, that promises to be a bit inefficient. Can you imagine a separate foundation for every startup that’s gone public? It would be a mess. Equity grants could just as easily be allocated to existing foundations based on strategic alignment and compatibility.

Beyond that, as more and more valuable companies emerge beyond Silicon Valley it’s a good time to hop on board to make an impact closer to home and in the regions that need it most. It seems that some of China’s hottest unicorns are riding the wave, Pinduoduo recently committed 2.73% of equity to Starry Nights Foundation focused on ‘social responsibility and scientific innovation’. What if Mercado Libre had done that? What if Indonesia’s Grab follow’s suit? It’s literally a billion dollar question.

A final note

Let me just be clear that I do not think that philanthropic foundations hold the solutions to our wicked problems. They are not enough. In fact, there’s a reason why foundations are so much larger and more prominent in USA than in Europe. With a much smaller social safety net than most advanced European nations, philanthropies in the USA make up for the shortcomings of many government services. European foundations also fill those gaps, but more often do so by working with and supporting existing government initiatives. While entrepreneur-driven philanthropy is not the solution to our problems, it is a vast source of capital that can be allocated to good ends. If corporations have the legal rights of persons (its true at least in the USA), we can expect them to act like decent citizens that uphold a social contract in place of blindly seeking profits.

After all, even one of the pre-eminent fathers of Capitalist Henry ford once said:

A Business That Makes Nothing but Money Is a Poor Business

❗❗❗ What’s your take? Curious to hear your reaction on this topic.

Comment below to start a discussion or share this post to discuss with a friend

To receive this newsletter, subscribe below 🙌🏻