Understanding Nubank

A teardown of NuBank's filing from one of our advisors

Hello Global Builders —

Welcome to the Next Billion Advisors newsletter, focused on highlighting the lessons from a collection of entrepreneurs and operators with experience bringing technologies across emerging and frontier markets.

This piece was originally written by Tanay Jaipuria (Nov 2021), one of our advisors and first appeared in his weekly newsletter. Be sure to check it out!

Building a “multi-product” neobank

Nubank is the world’s largest neobank with over 48M customers in Brazil, Mexico and Colombia, including 1.1M SMEs.

While the end goal for many fintech companies is to be a bank, very few start off like that. Most start with a single product typically targeted at their core customer segment which serves as a wedge and then layering on other products as they make their move towards becoming a bank.

Nubank started off with a credit card product, which was their initial wedge to acquire customers. Since then, they have expanded their product suite over time, with the pace of expansion continuing to accelerate, as in the chart below.

Nubank today offers products across the five key financial areas:

Spending: debit card and credit card, mobile payments

Saving: personal and business accounts

Investing: equity, fixed-income, options and ETF products

Borrowing: personal unsecured loans and BNPL

Protecting: life insurance policies

With a large captive customer base, they intend to continue adding products in the future including additional credit products, other types of insurance policies and new investment solutions.

The Compelling Latin America Opportunity

Nubank is trying to be the go-to financial company for everybody in Latin America which is a compelling market for a few reasons:

A. The market is significantly underpenetrated

Due to low levels of financial inclusion and high costs, many people in Latin America remain unbanked, which Nubank can address.

Brazil: 30% of the 169M people over 15 didn’t have a bank account

Colombia: 55.1% of the 40M people over 15 didn’t have a bank account

Mexico: 64.6% of the 96M people over 15 didn’t have a bank account

That accounts for over 130M people by itself that remain unbanked.

B. A concentrated sector with low innovation historically

The banking sector is highly concentrated with five largest banks controlling ~70-85% of the market in these countries.

Given the high concentration, the customer experience has typically been poor, the fees have been high and the lack of competition has resulted in a lack of innovation.

C. High costs to serve which make it ripe for disruption

The incumbent banks have high costs to serve given their large branch footprints and their large workforces. In Brazil for example, these banks have over 80,000 employees each and ~2,000-5,000 branches.

This results in high costs, which are typically passed on to the customer in the form of fees.

In many ways, this is a market where the value proposition and need for an alternative was extremely high, much more than some places such as the US, where the underbanked population is relatively small, and while the existing banks are not digital, do compete relatively fiercely with each other (at least for certain segments of customers).

Nubank’s Customer Obsession

One thing that stands out and differentiates Nubank from its competitors is their customer obsession. In particular a few aspects related to their customer-centric culture stand-out:

A focus on developing delightful mobile and digital first customer experiences which are simple and integrated.

A culture of thinking like owners rather than renters, which is helped by 76% of employees owning shares in Nu

A culture of pursuing smart efficiency and optimizing the use of scarce resources in order to gain efficiency which they are able to pass on to their customers

Creating actually accessible products with lower fees than competition

While it is fairly common for companies these days to say they are customer-centric and customer-obsessed, in the case of Nubank this customer-centricity is pretty evident in some of its metrics.

A. High NPS

Banking tends to be an industry of “passive loyalty” - people aren’t in love with their existing provider, but don’t want to deal with the hassle of switching providers and so stay with their existing one.

Nubank has created a product which customers genuinely love and which likely has active loyalty.

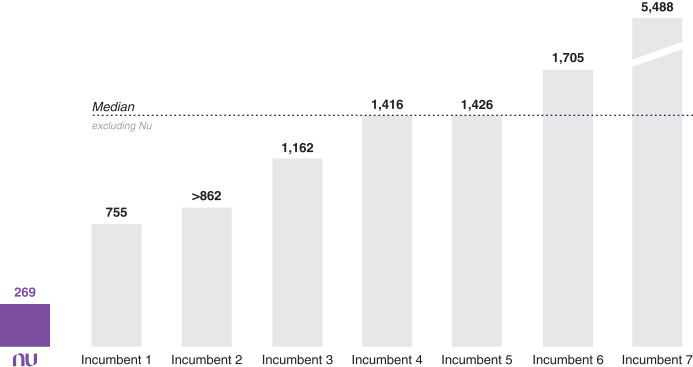

They’ve been able to maintain NPS levels of ~90 as they’ve continued to scale, which is quite impressive. This is far greater than incumbent banks, and also comparable to the very best products and companies of any kind globally!

While NPS is admittedly a bit soft a metric which can be “gamed”, based on their relatively standard definition and way of measuring it, it is a good proxy for customer satisfaction.

B. Low complaint volume

Nubank receives far fewer complaints per million than its competitors. In addition, they focus on customer support and have developed a set of self-service tools known as Shuffle and a highly trained support team of agents known as Xpeers which help ensure that those who do need customer support have a great experience, which helps maintain customer satisfaction.

99% of the calls received were answered in less than 45 seconds and the customer satisfaction rate for the calls exceeded 92%.

C. High Word-of-Mouth

80-90% of Nubank’s customers are acquired organically through word-of-mouth or unpaid referrals. This obviously is incredibly meaningful when it comes to their economics which I’ll get to in a bit, but also highlights their customer obsession in creating a great product which serves the needs of customers incredibly well.

Business Model

So how does Nubank make money?

At a high level, their business model is not dissimilar to any other bank, except they don’t tend to charge many types of fees (such as to maintain a debit card / credit card, etc.) and takes two main forms:

Interest Income (~55% of revenue): Interest income is primarily generated on credit cards and loans, followed by other interest income on financial instruments (deposits and govt bonds)

Fees (~45% of revenue): The main driver of fees are interchange fees which are earned on the volume processed by credit cards and debit cards. This is followed by smaller sources of fees from recharges, rewards and late fees as well as other commissions on life insurance products and similar.

The chart below highlights these sources of revenue, based on 2021.

A couple of points are worth noting:

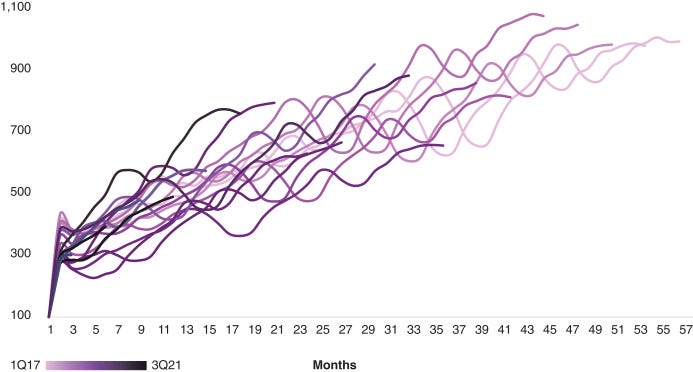

Interchange fees: Interchange fees are the largest revenue stream representing 30% of revenue and are directly related to the purchase volume on cards which grew almost triple digits to $30B so far in 2021. The current net interchange fee rate is 1.1%, and Nubank is already processing almost ~10% of all credit card volume in Brazil. As in the chart below, the monthly average purchase volume by cohorts has been trending well.

No fees on many products: Nu does not charge fees on many products such as their core credit and debit card, their mobile payments products and their personal and business accounts. In some ways they are definitely under monetizing relative to competitors but at the same time this is their differentiator and driver of low-cost acquisition and customer growth.

Interest earning portfolio: Interest income from loans and credit cards is highly dependent on the volume of the interest-earning portfolio. That number has grown remarkably between 2020 and 2021 (over ~250%) and stands at over $1.4B.

Deposits: Deposits is another key metric since its growth represents $ which can earn a spread for Nubank (and also be lent to other customers). As customers have grown and as they have grown their usage of Nubank, deposit growth has been fairly high, typically in the triple digits. As of Sep 2021, Nubank has over $8B in deposits, ~$168/customer.

Revenue per customer

The upshot of all of this is that Nubank generates a revenue of ~$4.9 in monthly average revenue per active customer. This number has been growing over the past year (~25% y/y) as users attach to more products and start using Nubank for a greater share of wallet. However, in general, newer users have lower Monthly ARPACs, and so an increase in customer growth has also meant that this number faces downward pressure.

Incumbent banks have monthly APRACs of $38, which is roughly ~8X that of Nubank’s. Given Nubank’s lower fees, while they might not reach that level, there is significant room to grow ARPACs by focusing on:

Increasing penetration of existing products and share of wallet within existing customers

Cross-selling additional products to existing customers

There are signs that Nubank is able to do both of these.

Firt, based on the cohort data, monthly ARPAC has increased as customers age and adopt new products and increase share of wallet, as below.

Second, Nubank has been able to cross-sell products such as personal loans to customers, and the set of customers who were active across their core products, which include credit card, NuAccount and personal loans had Monthly ARPACs in the US$23-US$34 range.

Over time, users have been using more products, right from the get go and as they age, as below.

If you don’t receive insights from our network of advisors, please sign up and join a global community of builders:

Make sure to also check the newsletter from Tanay, one of our advisors.

GTM and Customer Acquisition

David Velez, the founder of CEO of Nubank, on a podcast with Patrick O'Shaughnessy said that one of the key bets of Nubank was to create a great product with no fees, and hope that the better pricing and product meant that they could acquire customers more cheaply than incumbent banks.

Some of the bets that we had an initially was, let's charge nothing to the consumer. Hopefully, that translates into no customer acquisition cost. Google, Facebook, they lose. That money stays in the customer's pocket. That bet worked. We charge no fees, but our customer acquisition cost is effectively zero even today.

That bet worked remarkably well and Nubank hasn’t changed their core ethos much. The focus has been on a great product with great pricing which in some ways basically sells itself.

At a high level, the GTM approach of Nubank is to focus on being a great all-digital cloud-based bank which reaches customers by:

A. Prioritize high-quality customer experiences to drive organic word-of-mouth advertising and customer referrals

Between low fees and a great product, Nubank has focused on a “member-get-member” marketing strategy where delighting customers leads to them referring their friends and family to Nubank/

In a generally competitive fintech market where CACs continue to rise, the fact that Nubank has created a product where 80-90% of customers per year are acquired organically through word-of-mouth or unpaid referrals is quite remarkable.

B. Social Media and Content Marketing

Nubank has maintained a strong social media presence to drive awareness and engage with customers. They have ~9.6M followers across their channels today.

They have also partnered with selected influencers such as Brazilian pop star Anitta.

Lastly, they have focused on creating educational content to strengthen their brand and attract new customers. This has helped them rank highly in search engines for key topics and drive 110M+ organic visitors in aggregate over time. In addition, their financial education newsletter has over 2M subscribers!

In aggregate, Nubank is spending less than 5% of their total revenue on marketing, and approximately ~4X that on R&D in developing a great product, and ~3X that in providing great customer support.

It's been viral, which is unexpected for a financial services product. You don't see a credit card has no virality characteristics. There's no real network effects when you think about it. It's not Facebook. It's not Instagram, where if all your friends are there, you want to be there. Here, you will have a loan product that doesn't necessarily make it better for your friends ... But in general, most people will hear from us through a friend, will download the app or will be invited by a friend. The friend will send you an invitation via WhatsApp or email or Facebook or any type of channel. You accept the invitation. You download the app. And in a few seconds or a few minutes, you have a bank account open. You have a credit card, a virtual credit card working. We'll send you a physical credit card to your house in one or two days it's there.

Overall Unit Economics

We’ve talked about the business model and the customer acquisition above. So, what does that mean for Nubank’s unit economics?

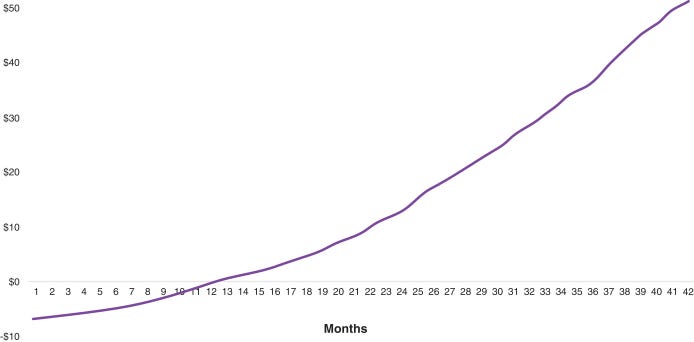

Average CACs are ~$5 given that ~80% of customers come in through organic channels, which is in line with the very best fintech products in the world.

The contribution margin payback period on this CAC is less than 12 months on average which is quite remarkable, as the chart below illustrates.

As we think about LTV, if we consider a few things:

Monthly ARPAC is $4.9 and growing as users adopt more products and increase their share of wallet

~75% of customers are active, a number which has grown over time.

Churn is very very low: People rarely leave banks, especially good ones. So it isn’t a surprise that Nubank has an aggregate monthly churn of ~0.13% (0.06% voluntary and 0.07% involuntary). If you do the math, that’s an expected lifetime of over 50 years.

Operational Costs are low driven by no branches, a proprietary risk system and automating processing leading to ~50% gross margins.

When factored with the ~$5 CACs, Nubank has an estimated LTV/CAC of >30X, which is just incredible.

In general, an LTV/CAC of 3x is considered good, but this is literally a magnitude better!

Overall Financials

In terms of aggregate financials, Nubank is on track to do ~$1.5B in revenue in 2020, growing 99% year over year.

As in the table below, at an aggregate level, all the key revenue drivers for Nubank are trending in the right direction:

Customer growth has been strong

A higher percent of customers are becoming and remaining active

Customers are adopting more products and spending a higher share of their wallet resulting in higher ARPACs, despite customer growth

From a profitability perspective, while Nubank isn’t profitable yet, things are generally heading in the right direction, with operating margins -8%, which isn’t too bad considering the growth.

In terms of key drivers:

Gross Margin has steadily increased from ~35% to ~48% over time as Nubank’s customer base has grown. In addition, the cost to serve per customer has also gone down due to scale and increasing efficiency. In particular, transactional expenses have gone down as Nubank has grown in scale.

Customer support and operations represents 12% of revenue, down from 15-18% of revenue, and includes customer support and infrastructure and data processing costs related to providing service to customers.

G&A, which is the largest operating expense bucket, has grown to 38% of revenue as Nubank has been investing in growing their headcount, including engineering personnel. The bucket essentially also includes R&D spend, and so a large number isn’t too surprising and could suggest that Nubank is just continuing to invest heavily in product development and creating new products, which should help grow revenue down the line.

Marketing expenses overall are pretty minimal, with Nubank spending <5% of revenue on marketing. However, this bucket has grown in recent times, which indicates that Nubank might be investing more heavily in customer acquisition given the attractive unit economics.

Overall, while Nubank is not profitable today, given its strong growth and strong unit economics, it is really more a question of when they choose to do rather than any real questions about their ability to become profitable. Given the ability to continue to penetrate the large market with a significant number of people still unbanked, and the ability to continue to grow wallet share and penetration within the customer base, I wouldn’t be surprised if Nubank continues to invest heavily in product development and even ups their marketing spend in the near team and stays aggressively focused on growth.

Note: this was originally published in November 2021

Thanks for reading 🙌 Feedback? Please. Building something for the next billion? Please reach out: on our website, Twitter or LinkedIn. If you haven’t yet, please subscribe and share!